How Are Errors and Omissions Insurance Necessary?

Liability lawsuits can be so expensive without errors and omissions (E &' O)insurancethat your company may be forced to shut down. Even if your consumer decides not to claimtheir complaint, you could be looking at thousands of dollars in legal costs. If you're found liable or agree to an out-of-court settlement, you'll be on the hook for a sizable sum of money.

That's why it's crucial to have errors and omissions (E &' O)insurance in place for your business.

E&'O Insurance: Is It Necessary for whom?

E&'O insuranceis mandatory for companies that provide a service to their clients. Included here are:

- Accountants

- Companies that employ engineers and those that provide engineering services

- Marketing agencies

- Educators

- Website developers

- Organizations that provide expert advice

- Salons and barbershops

- Publication houses and printing presses

- Veterinary care and pet grooming

- Pet services are examples.

Aspects of Your Business Not Protected by E&'O Insurance:

Your policy's retroactive date does not cover claims for events that occurred before that date. The more extended filing deadline doesn't help your firm with claims that come in after the policy's reporting term has expired.

Errors and omissions (E &' O)do not cover every form of liability suit, so be mindful. With this policy, you will not be able to defend yourself against claims of:

- Deceiving your consumers or clients or knowingly breaking the law are examples of illegal behaviors.

- Your company's negligence has resulted in injuries to individuals or property. Because of this, you require a public liability insurancepolicy for this kind of claim.

- Workers' compensation claims for injuries or diseases resulting from their job. Workers' compensation insurancecan help your employees recover from a work-related injury or illness by providing them with financial assistance. Consider the fact that many states demand this policy if you employ people.

- Your employees make complaints of discrimination or harassment at work. You can protect yourself by purchasing a policy for employment practices liability insurance.

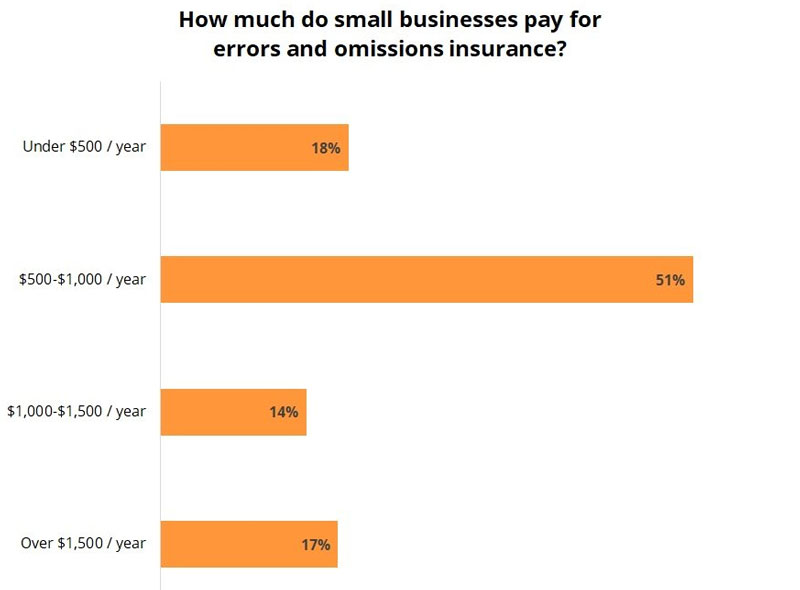

Cost of insurance forerrors andomissions:

The cost of your mistakes and omissions insurancewill vary depending on your company's specific needs. However, buying an insurancepremium is always worthwhile when you consider the financial damage that might be done to your organization due to mistakes.

Your errors and omissions (E &' O)insurance premiums can be reduced by:

- Educating your workers

- Performing a quality control audit on your contractual system

- Keeping in touch with consumers frequently to ensure they're satisfied is one way to lower your insurance costs.

As a business owner, you'll pay extra for insuranceif your industry is considered high-risk. It is not uncommon for a prominent financial advisor to claima more significant premium than a lesser financial advisor who advises clients on investing millions of dollars.

For the most part, the larger your insurancelimit, the more expensive your premiums will be.

Claims history: If your company has past liability claims, you may have to pay a higher premium for E&'Oinsurance.

If your firm is located in a specific location, you may be charged a different rate than someone else.Your insurance prices may be higher if your company is located in a crowded city, for example.

What is covered under E&'O Insurance?

Your business is protected by errors and omissions insuranceagainst claims of:

- Negligence

- Mistakes in the quality of the services provided

- Omissions and Misrepresentation

- Violation of fairness and honesty

- Erroneous information

- Professional services liability insurance can help cover your costs if a customer files a lawsuit against your company because of a blunder.

Attorney fees, which might range from $3,000 to $150,000, can be expected to be paid.

An attorney's fees, such as the cost of booking a courtroom or hiring experts.

You'll have to pay for things like office staff and court reporters as you put together your defense.

Litigation, which can range from a few thousand dollars to several million.

Claims can only be covered by E&'Oinsuranceif:

- Following your policy, or during the extended reporting period, it has been submitted

- On or after your retroactive date, the occurrence occurred.

- Incidents occurring on or after a specific date in your policy's retroactive period are covered. Claims filed within a set amount of time after the expiration of your policy are covered by the prolonged reporting period.

Thoughtful Mother’s Day Gifts and Activities

Should You Upgrade Amex Delta Blue to Delta Gold?

Essential Questions to Ask a Mortgage Lender

Student Loan Limits

How Soon After Buying a Car Can You Refinance It?

Constantly looking at charts and monitoring transactions will only impede your trading

Can Gaps Be Avoided With Stop or Limit Orders

Top-down Vs. Bottom-up Investing

APR vs Interest Rate On A Loan: Explore The Differences

Mastering the Art of Credit Card Balance Transfers with Wells Fargo

A Motto Mortgage Review – Long-Term Growth Potential