When it comes to credit cards, simplicity often reigns supreme. The Capital One Platinum Credit Card is a shining example of straightforward, no-frills designed to cater to those looking for a reliable financial tool without all the bells and whistles.

In this review, we'll dive deep into the Capital One Platinum Credit Card, examining its features, benefits, Annual Fees, and more to help you decide whether it's the right card for you.

The Basics

If you're new to the world of credit cards or working on improving your credit, the Capital One Platinum Credit Card's straightforward approach could be just what you need.

Interest Rate

The Capital One Platinum Credit Card, as of my last knowledge update in September 2021, typically offers a variable APR (Annual Percentage Rate) for purchases. The specific rate depends on your creditworthiness, but it's essential to understand that this card may be more accessible to those with average Credit Scores.

Therefore, the Interest Rate could be higher than cards designed for individuals with excellent credit.

Credit Limit

This card usually starts with a lower credit limit, which can be both an advantage and a limitation. On one hand, it's a great option for those building or rebuilding credit, as it minimizes the risk of accumulating too much debt. However, if you're looking for substantial purchasing power, the initial limit might be restrictive.

Over time, with responsible card usage, Capital One may review and increase your credit limit.

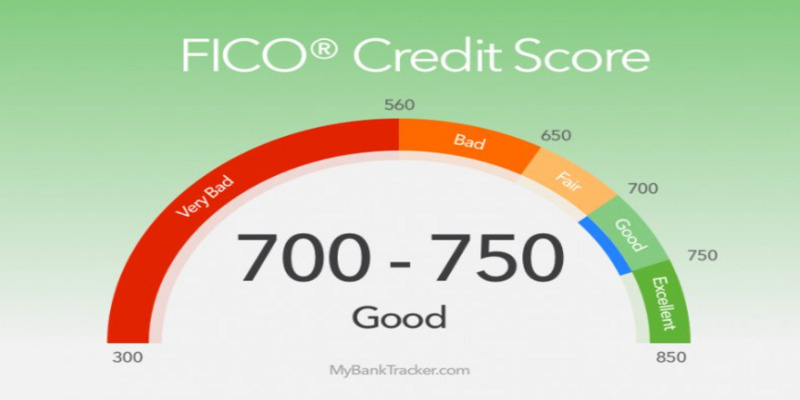

Credit Score

This card offers a unique advantage: it can potentially boost your Credit Score significantly. When you use it responsibly, making timely payments, you demonstrate positive credit behavior to the credit bureaus. This, in turn, can have a lasting positive impact on your Credit Score, helping you secure better financial opportunities in the future.

So, while it may not provide cashback or rewards, its power to enhance your creditworthiness makes it a valuable financial tool.

No Annual Fee: A Budget-Friendly Advantage

The Capital One Platinum Credit Card presents a significant advantage right from the start - it comes with no Annual Fee. This is a welcome feature for budget-conscious individuals in a world where many credit cards charge a yearly fee.

Financial Flexibility

The absence of an Annual Fee means you won't have to worry about setting aside funds just to keep the card active. This financial flexibility allows you to allocate your resources where they're needed most without the burden of an additional financial obligation.

Ideal for Credit Building

While some cards with no Annual Fee might lack other benefits, this one is designed to aid you in building or rebuilding your Credit Score. The lack of an Annual Fee combined with this credit-building focus makes it a practical choice for those striving to improve their creditworthiness.

Access to Credit Education Tools

Furthermore, the Capital One Platinum Credit Card provides valuable credit education tools to help you make informed financial decisions. These resources can be instrumental in understanding and managing your credit profile effectively, contributing to your overall financial well-being.

No Rewards, No Problem?

While it might not shower you with cashback or rewards, this card primarily focuses on helping you build a more substantial credit foundation.

No Cashback or Rewards

Here's where the Capital One Platinum Credit Card takes a spartan approach. It doesn't offer cashback, rewards points, or any fancy perks. If you're looking for a card that gives you cash back on your purchases or provides travel rewards, this card might not be your best bet. But remember, simplicity is its core strength.

Ideal for Credit Building

Rather than offering cashback or rewards, the Capital One Platinum Credit Card prioritizes assisting individuals in establishing or restoring their creditworthiness. If you possess a less-than-ideal credit history, this card is an exceptional entry point for your journey.

Surprisingly, Its lack of rewards can be a hidden advantage, as it mitigates the temptation to overspend solely for earning points or cashback, encouraging responsible financial habits instead.

Credit Education Tools

Capital One provides various resources and tools to help you manage your credit wisely. These include access to CreditWise, which allows you to monitor your Credit Score, track your progress, and receive alerts about significant changes. This is an invaluable tool for those serious about improving their creditworthiness.

Potential Downsides

Before committing to this card, consider factors like foreign transaction fees and the absence of premium perks that might impact your financial situation and lifestyle.

Foreign Transaction Fees

If you're a frequent traveler or planning to use your credit card for international purchases, be aware that the Capital One Platinum Credit Card charges foreign transaction fees. These fees can add up, making it less than ideal for overseas use. If you're a globetrotter, you might want to consider a different card with no foreign transaction fees.

Limited Perks

While this card keeps things simple, you won't enjoy the perks of more premium credit cards. No airline lounge access privileges, extended warranty coverage, or purchase protection benefits exist. If you value these perks, you might want to explore other Capital One credit card options or cards from different issuers.

Limited Initial Credit Limit

As mentioned earlier, the initial credit limit can be lower. While this helps manage your spending, it might not be suitable if you're looking for a card with a more substantial credit line. However, with responsible credit use, you may qualify for credit limit increases over time.

Conclusion

In a world where credit cards often dazzle with rewards and perks, the Capital One Platinum Credit Card stands out for its simplicity. If you're building or rebuilding your credit, this card can be an excellent companion on your journey.

Its lack of an Annual Fee and access to credit-building tools make it a practical choice for those looking to improve their financial standing.

Capital One Platinum Credit Card: A No-Nonsense Review

What Is Mobile Check Deposit?

Five Ways to Turn Your Backyard into a Summer Oasis

Businesses That Amazon Owns

Decoding Exchange Rates: The Currency Conversion Puzzle

APR vs Interest Rate On A Loan: Explore The Differences

Top-down Vs. Bottom-up Investing

Essential Questions to Ask a Mortgage Lender

Can Gaps Be Avoided With Stop or Limit Orders

Choosing the right Debt Relief Service: what you must know before you sign up

Never let the loss exceed 10% of the capital